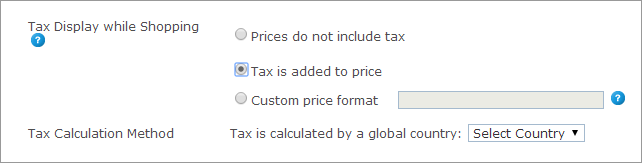

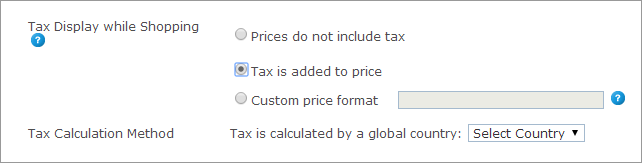

1. In the Localization section, under Tax Display while Shopping, select one of the following tax display formats that will be applied to your store:

– Prices do not include tax: The product prices will be displayed without tax.

– Tax is added to price: The product prices displayed in the store will include tax.

– Custom price format: Enter the custom price format using the following writing notation (the custom price format must include the tax format):

{Price}: Price, tax not included

{Tax}: Tax only

{PriceIncludingTax}: Price including tax

For example: {Price} + {Tax} VAT

Note that the Tax Calculation Method field is displayed only when the Tax is added to price or the Custom price format options are selected.

2. In the Tax is calculated by a global county list, select the country according to which the taxes will be globally calculated. This list will only include countries that are marked as supported for this store in the Supported Locations section. Only taxes that are defined for this country will be used in that store (see the Country field value in the Tax table). If you selected a country that was later removed from the list of Supported locations, you will have to modify the selection by choosing another country.

Tax

Group is disregarded during tax calculation for Shipping Price.

Tax

Group is disregarded during tax calculation for Shipping Price.